Building Sales Pipelines That Actually Convert: A Complete Guide

Building Sales Pipelines That Actually Convert: A Complete Guide

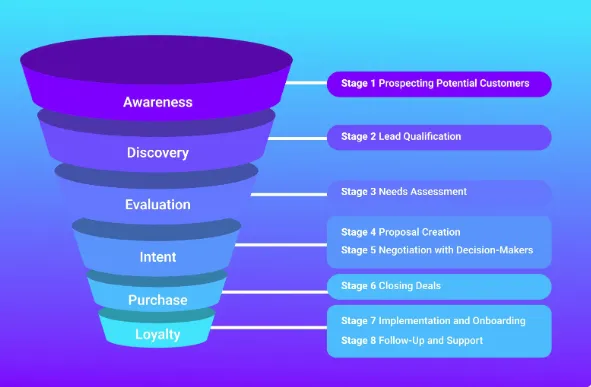

Sales pipelines are supposed to provide predictable revenue growth and clear visibility into future business performance. Unfortunately, most sales pipelines leak prospects at every stage, creating frustration for sales teams and unreliable forecasting for business leaders. The difference between pipelines that convert and those that disappoint lies in their design, implementation, and ongoing optimization.

The Pipeline Problem

Traditional sales pipelines often reflect wishful thinking rather than buyer reality. They're designed around internal sales processes rather than customer buying journeys, creating disconnect between what sales teams think should happen and what prospects actually experience. This misalignment leads to poor conversion rates, extended sales cycles, and missed revenue targets.

Many pipelines also suffer from stage inflation, where deals advance through stages based on sales activity rather than genuine prospect progression. A discovery call might move a deal from "prospecting" to "qualified," even if the prospect hasn't actually demonstrated any real buying intent or budget authority.

Poor pipeline hygiene compounds these problems. Deals that should be disqualified linger in pipelines for months, creating false optimism and preventing sales teams from focusing on genuine opportunities. Without clear exit criteria and regular pipeline cleaning, forecasts become unreliable and resource allocation suffers.

Designing Buyer-Centric Pipelines

Effective sales pipelines start with deep understanding of how your specific customers actually buy. This requires mapping the genuine buyer's journey, not the journey you wish they would take. Interview recent customers to understand their decision-making process, the stakeholders involved, and the information they needed at each stage.

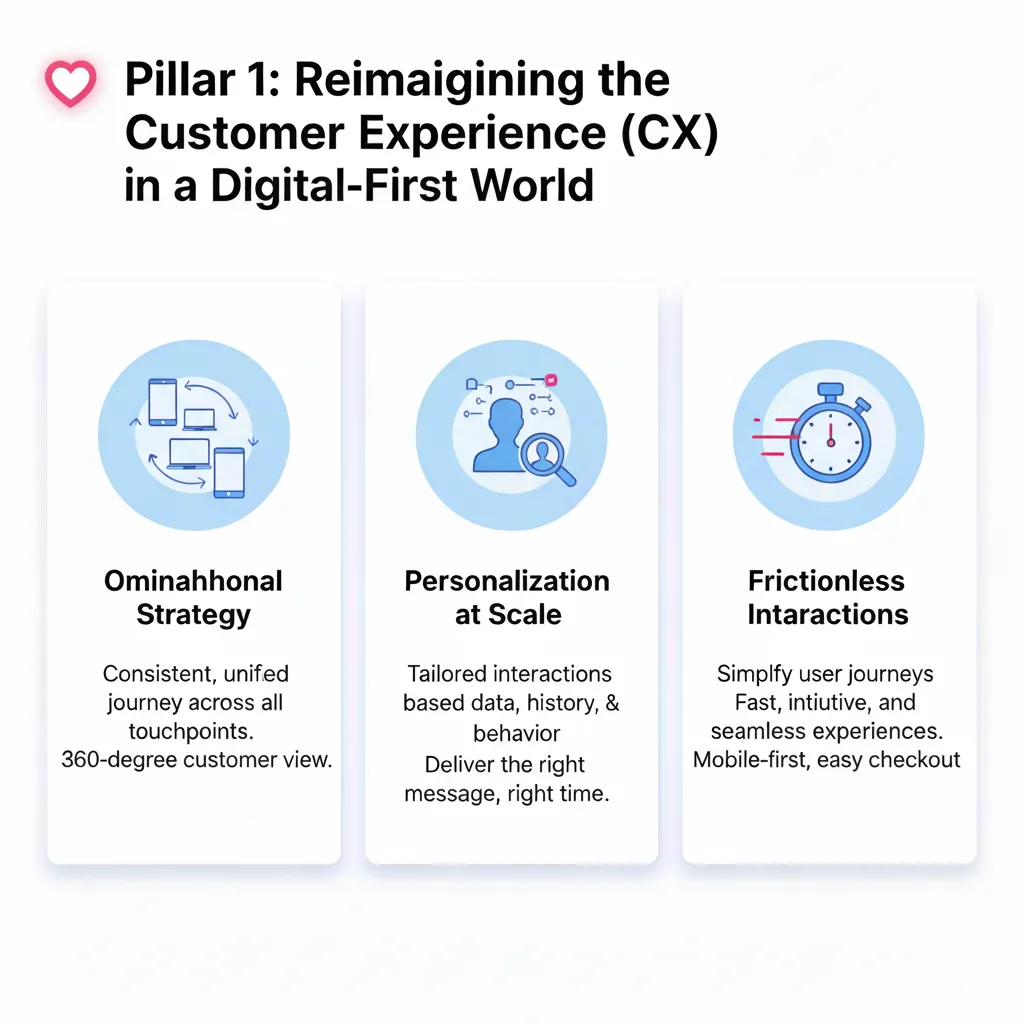

Value-Based Stage Definitions focus on customer progress rather than sales activities. Instead of defining stages by what the salesperson has done ("demo completed"), define them by what value the prospect has recognized ("solution fit confirmed"). This approach ensures that pipeline advancement reflects genuine buying progression.

Each pipeline stage should have clear entry and exit criteria that both salespeople and prospects understand. These criteria should be based on specific prospect actions or acknowledgments that demonstrate their readiness to move forward. For example, moving from "evaluation" to "proposal" might require the prospect to confirm budget availability and decision-making authority.

Multiple Pipeline Tracks accommodate different buyer types and sales scenarios. Enterprise deals follow different patterns than small business sales. New customer acquisition differs from expansion sales to existing accounts. Creating separate pipelines for distinct buyer segments allows for more accurate forecasting and appropriate stage definitions.

Technology Integration for Pipeline Efficiency

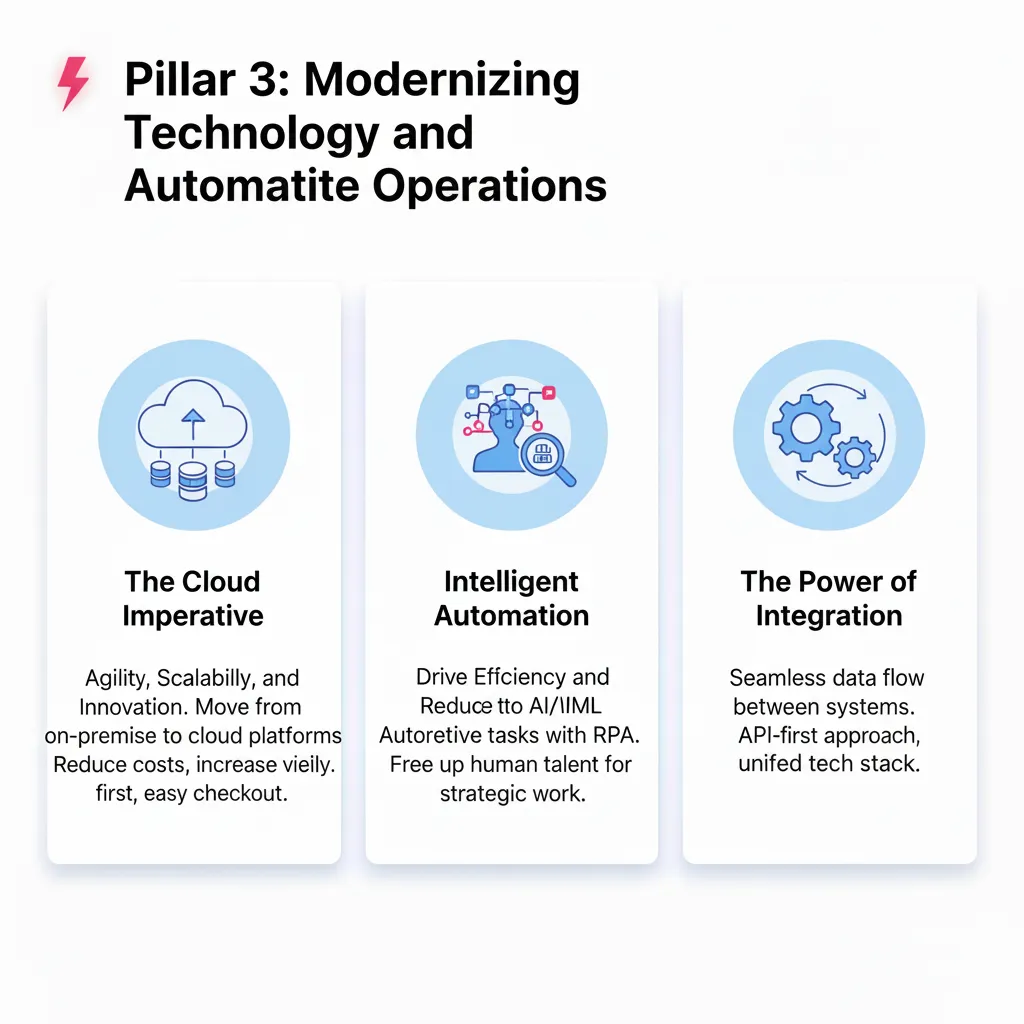

Modern CRM platforms provide automation capabilities that can dramatically improve pipeline performance. Automated lead scoring helps sales teams prioritize prospects who are most likely to convert, ensuring attention focuses on the highest-value opportunities.

Workflow automation can trigger appropriate actions at each pipeline stage. When a deal moves to "proposal," the system might automatically generate a proposal template, schedule follow-up tasks, and alert sales management. These automated workflows ensure consistent execution and prevent important activities from being overlooked.

Integration with marketing automation platforms provides valuable context about prospect engagement and behavior. Understanding which content prospects have consumed, which emails they've opened, and how frequently they've visited your website helps sales teams tailor their approach and timing.

Conversion Optimization Strategies

Bottleneck Analysis reveals where prospects consistently get stuck in your pipeline. If many deals stall between "proposal" and "decision," this suggests issues with your proposal process, pricing structure, or decision-making facilitation. Systematic analysis of conversion rates between stages identifies the most impactful improvement opportunities.

Regular pipeline reviews should focus on deal quality rather than just quantity. Examine why deals are advancing or stalling, what patterns emerge among your best prospects, and which sales activities correlate with successful outcomes. This analysis provides insights for improving both individual deal strategies and overall pipeline processes.

Velocity Improvement focuses on reducing the time deals spend in each stage without sacrificing quality. This might involve providing better sales tools, improving prospect education materials, or streamlining approval processes that cause delays.

Forecasting and Prediction

Accurate sales forecasting requires both pipeline discipline and historical analysis. Track conversion rates between stages over time to develop reliable probability models. A deal in "proposal" stage might historically have a 60% chance of closing, while a deal in "discovery" might have only 25% probability.

Weighted pipeline forecasting multiplies deal values by stage-specific probabilities to create more realistic revenue predictions. This approach provides better visibility into likely outcomes and helps identify when additional pipeline development is needed to meet revenue targets.

Leading indicators help predict future pipeline health before problems become critical. Metrics like new opportunity creation rate, average deal size trends, and time-to-first-meeting can signal whether your pipeline will support future revenue goals.

Team Performance and Development

Pipeline performance varies significantly among sales team members, providing opportunities for targeted coaching and development. Analyze individual conversion rates by stage to identify specific skill gaps or process adherence issues.

Top performers often have systematic approaches to pipeline management that can be shared with the broader team. Document the specific activities, tools, and techniques that correlate with high conversion rates, then develop training programs to help other team members adopt these proven practices.

Regular pipeline coaching sessions should review individual deals in detail, focusing on strategy development and obstacle identification rather than just status updates. These sessions help salespeople think more strategically about their opportunities while providing managers with insights into team performance patterns.

Continuous Improvement Framework

Pipeline optimization is an ongoing process rather than a one-time activity. Market conditions change, buyer behaviors evolve, and competitive landscapes shift, all of which can impact pipeline performance. Establish regular review cycles to assess pipeline effectiveness and identify improvement opportunities.

Customer feedback provides valuable insights into pipeline effectiveness from the buyer's perspective. Survey recent customers about their buying experience, what information they found most valuable, and where they encountered friction or confusion. This feedback often reveals improvement opportunities that aren't apparent from internal analysis.

Competitive analysis helps identify pipeline advantages and vulnerabilities. Understanding how competitors approach similar prospects can reveal opportunities to differentiate your sales process and create competitive advantages through superior buyer experience.

A well-designed, properly implemented sales pipeline becomes a powerful revenue generation machine that provides predictable growth and clear visibility into business performance. The investment required to build and optimize effective pipelines pays dividends through improved conversion rates, shortened sales cycles, and more accurate revenue forecasting that enables confident business planning and resource allocation.